iDynamics SII - Setup

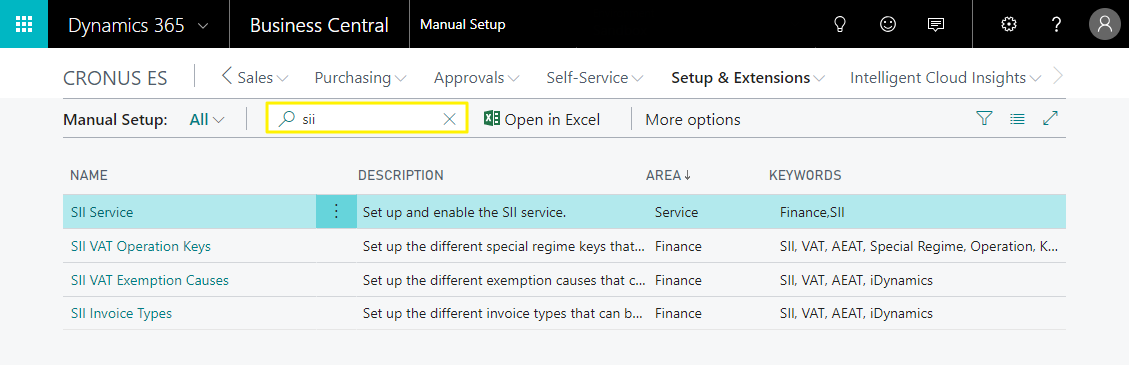

The setup of the different parameters to be established for the correct functionality of the app is carried out from the Manual Setup screen.

We can access all the different setup screens by filtering using the term "SII" .

General Setup Parameters

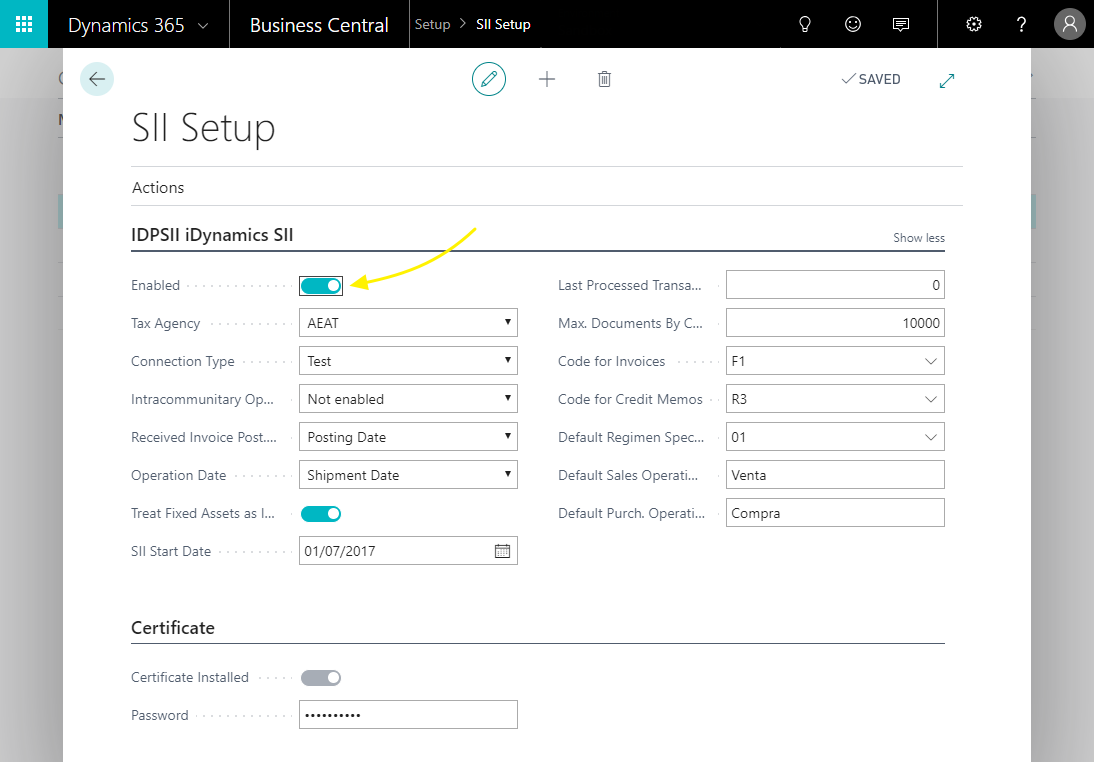

In order to be able to use iDynamics SII, it is necessary to configure the basic connection parameters, indicating the predetermined tax agency and the default parameters to be used.

The setup parameters are indicated from the SII Setup screen, which is accessible from Manual Setup.

Enabled

Enables or disables the automatic generation of documents in the sending queue of the SII, and whether they are sent to the tax agency, after the registration of invoices, credit memos, or any other document that is likely to be sent.

If it is disabled, it will be possible to load the document queue and send the documents to the tax agency, but only manually from the document queue.

Tax Agency

This is used to indicate the tax agency that will be used by default to communicate VAT/IGIC information.

Configuring the VAT registration groups allows you to set up a different tax agency for the documents that apply that VAT registration group. So, if a customer is based in Spain and the Canary Islands, for example, VAT invoices are sent to the AEAT, and IGIC invoices are sent to the Canary Islands tax agency.

Connection Type

This determines the URLs of access to the SII service to be used for communication. It allows the following selection:

- Tests. It will send the data to the test environment of the selected tax office.

- Production. It will send the data to the production environment of the selected tax office.

- Production (with seal). It will send the data to the production environment of the selected tax office, using a "seal" type certificate (usually used by public entities).

- Manual. This last case is available as a precaution, in case the selected tax office changes the URLs with respect to the predefined ones.

Before selecting the connection to the production environment, we recommend testing the setup of the digital certificate and the rest of the SII values with the test environment.

Intra-Community Operations

You can specify whether you want to automatically generate intra-community operation book entries for all invoices issued and received that correspond to European customers/vendors.

By default, this option is deactivated and can be generated manually in the corresponding specific cases, using the action Create Intra-Community Operation available within the SII document file, on issued and received invoices.

Received Invoice Post. Date

This is the date that will be sent to the tax office as the date of registration in the system (from which the 4-day period will count until delivery). It can be the Posting Date or the Creation Date within Microsoft Dynamics 365 Business Central.

The value to be selected will depend on whether you want to report the invoices received in your Issue Month, or in your Receipt Month (if it was received in the month following its issue). We recommend checking out the examples for more information on how to configure this field.

Operation Date

By default, iDynamics SII searches for delivery notes associated with an invoice, and uses the date of the first delivery note as the operation date (option: Delivery Date).

If you do not wish to apply this calculation, and you prefer the date of operation to always coincide with the date of shipment/posting of the invoice, select the option Shipment/Posting Date.

Treat Fixed Assets as Invest. Goods

If this field is active, all purchase lines corresponding to Fixed Assets will generate a communication of Investment Goods in the document queue.

If it is not active, this type of communication will only be created for the product posting groups that have the Investment Goods mark.

SII Start Date

If your company has just started sending data through the SII, and the inclusion date is different from January 1, you must send all documents between the date of the beginning of the exercise and the date of the beginning of the SII application according to specific criteria.

iDynamics SII will apply these criteria to all the documents generated in the document queue that have a registration date which is anterior to the date specified here.

Last Processed Operation

The next time you run the process to export data to the SII, all documents related to G/L entries with an operation number higher than the one specified here will be included.

This number is automatically updated each time the export process is executed, and the edition of this field will only be necessary in two cases:

- When you start using the integration with the SII, to indicate from which entry you want to start sending data (remember: the record indicated here will NOT be sent).

- If the data have been sent to the SII test environment, or if there has been a problem that requires the data to be sent again, this value could be modified.

Note: when processing the entries, the application detects if this document already exists in the SII connection queue, creating only those that do not exist.

Max. Documents by Connection

Tax agencies allow up to 10.000 invoices to be sent per communication, and iDynamics SII uses this value as the maximum limit when sending data. If there are more records, iDynamics SII internally sends all the necessary shipments until the document queue is processed.

There may be cases in which we want to reduce this value, for example if we encounter timeouts due to network connection problems, or Dynamics 365 Business Central overload problems (iDynamics SII will load into memory all the records corresponding to a shipment while it is being processed).

Code for Invoices

Unless simplified invoices (tickets) are being issued, or the tax office adds or modifies any code that applies to the company, it is recommended to leave the default value (F1).

The value of this field corresponds to the type of invoices we are generating, according to the codes typified by the tax agency (following the table Type of Invoice Issued in the SII documentation).

Once the documents that are to be sent to the tax offices have been generated, the user will be able to modify the type of each communication individually. If you want to automate the assignment of other types (e.g. simplified invoices) depending on the type of invoice, it is recommended to check the developer documentation, which includes examples.

Code for Credit Memos

This indicates the value, according to the codes typified by the tax office, to which correspond the credit memos issued in Dynamics 365 Business Central.

Just as the invoice type, the credit memo type can be edited manually before being sent to the tax office, and the assignment of different types can be automated using the customization events detailed in the developer manual.

Default Regimen Special Key

When an invoice is sent to the tax agency, it must be identified with the type of operation or special regime with tax significance. This is a code that can optionally be configured at the product posting group level, or at the VAT registration setup level.

The value indicated here will be used for all sales and purchases of products that belong to a posting group, or have a VAT registration setup, which do not have a specific key assigned.

Note: if the list of values is empty, go to the Special Regime Keys section at the end of this document.

Default Sales Operation Description

When a document is sent to the tax agency, a small description must be added, indicating the type of operation carried out. In this field, you must specify the default description for all operations. This description, as well as the special regime key, can be customized at the Product Account Group level, or at the VAT Registration Setup level.

This is the description that will be used for sales operations.

Default Purch. Desc.

This field is identical to the previous one, but for purchasing operations.

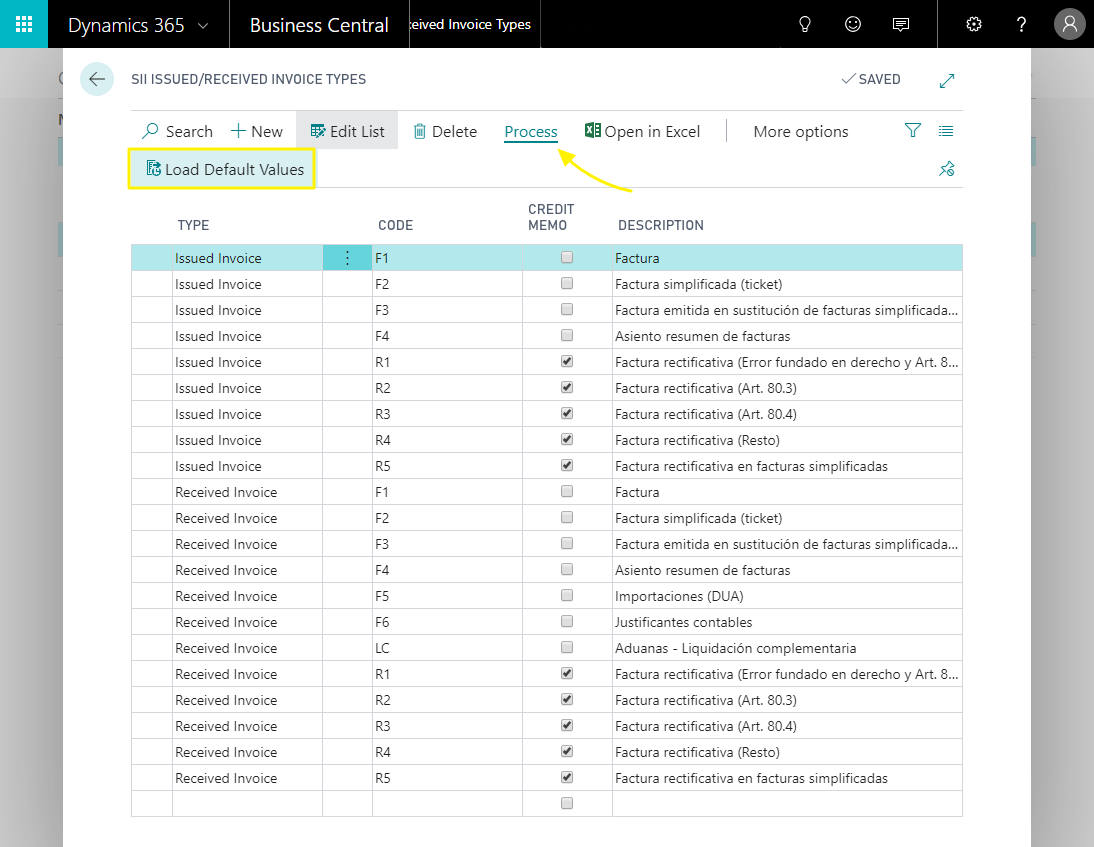

SII Issued/Received Invoice Types

When an invoice issued or received is sent to the tax agency, the type of invoice to which it corresponds must be specified (e.g. simplified invoice, summary invoice, etc.). iDynamics SII will automatically assign the predetermined codes in this field, which by omission correspond to "normal" invoices and credit memos, however it allows the type in the document output queue to be modified manually.

The list of invoice types is defined by the tax agency and is automatically generated by iDyanmics SII when the extension is installed. It is also possible to regenerate this list by clicking on the "Load Default Values" button available from the List of Invoice Types (accessible from Manual Setup).

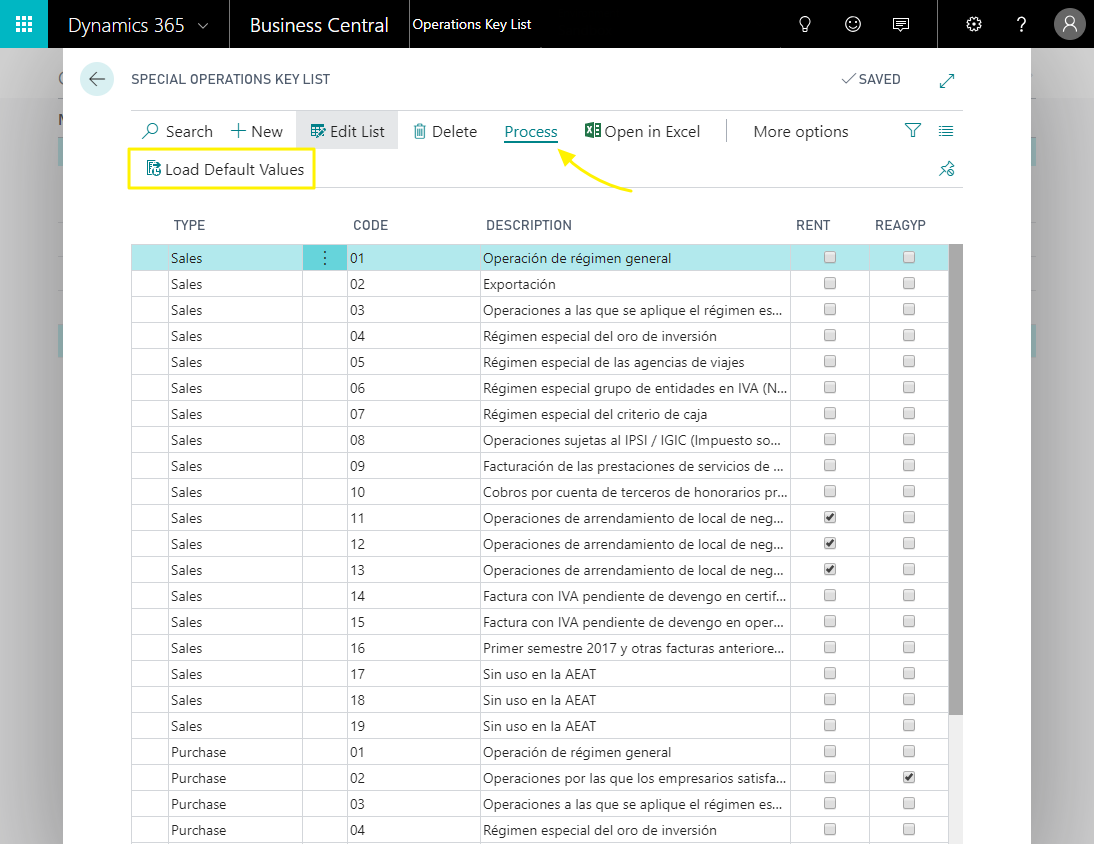

Special Operations Key

When a document is sent to the SII, the type of operation or special regime that corresponds to it must be specified, depending on the products or services contained therein.

The list of keys is defined by the tax agency and is automatically generated by iDynamics SII when the extension is installed. It is also possible to regenerate this list of keys by clicking on the "Load Default Values" button available from the Special Operations Key List (accessible from Manual Setup).

Rental Operations

Leasing operations have a specific code, and require extra data at the time of exporting the corresponding entries to the SII.

If you look at the screenshot for Special Operation Keys (above), you will see that some of the records have the Rental column checked. Having indicated in the RENT item group the key code 13, we are indicating that all operations with this item groups will require extra information to be sent to the SII.

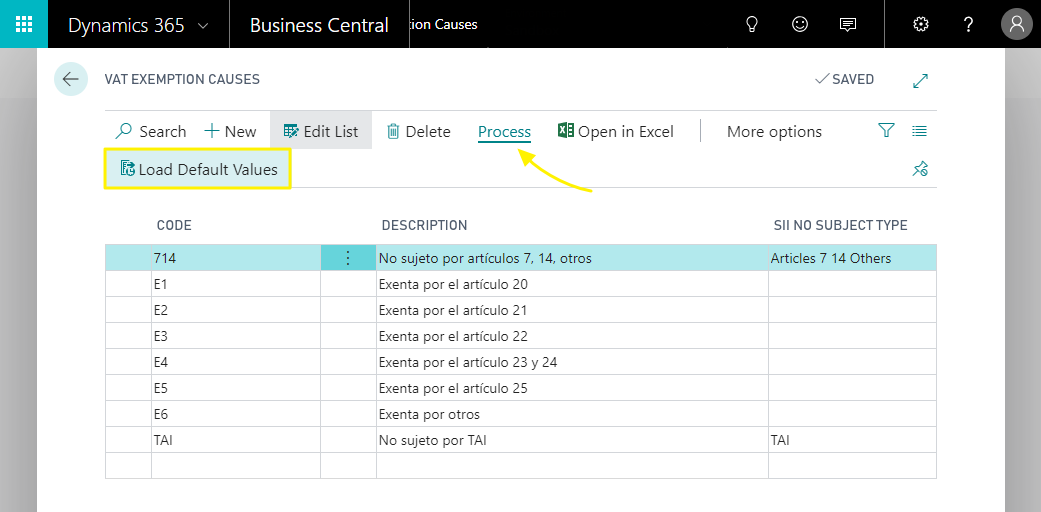

Causes for VAT Exemption

If VAT exempt documents are generated, the SII platform requires them to be typified, indicating a reason code.

The list of keys is defined by the tax office and is automatically generated by iDynamics SII when the extension is installed. It is also possible to regenerate the list by clicking on the "Load Default Values" button available from the List of Causes of VAT exemption (accessible from Manual Setup).

If you work with non-subject VATs, the Type not Subject SII field allows you to specify it, indicating the corresponding type. In these cases, and although the VAT is not subject, it will be necessary to configure the VATs as Type of VAT = Normal, since otherwise VAT registers would not be created, and would not be taken into account.

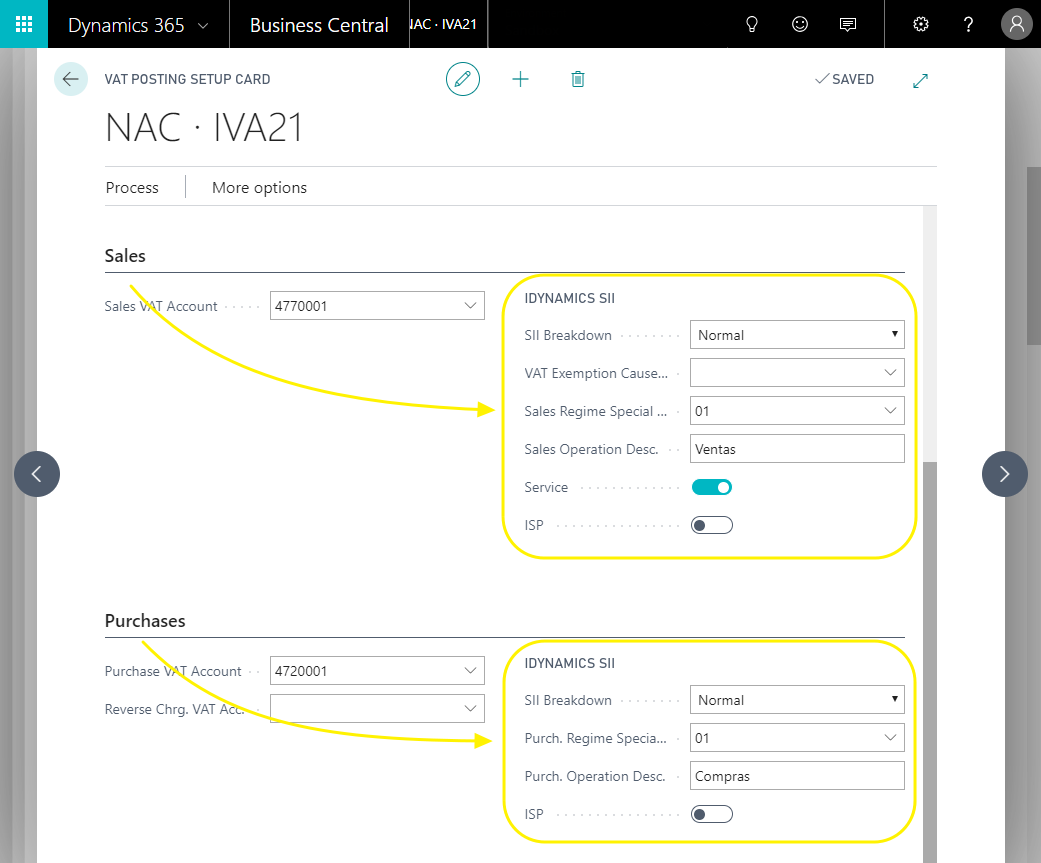

Config. of VAT Registration Groups

From VAT Registration Groups Setup we can access the setup of each of the groups, being able to indicate the parameters that affect purchases and sales, in a differentiated way.

SII Breakdown

This allows you to specify how the tax agency will be informed of the amounts affected by this setup.

- Normal: details of the amounts will be given to the tax agency.

- Ignore: information related to these amounts will not be sent to the tax agency.

- Only Total: the amounts will not be detailed to the tax agency, but will be taken into account for the calculation of the total amount of the invoice.

- Base Only: available only for purchases, lets you specify that the VAT amount should be ignored when sending the invoice to the tax agency.

We recommend checking the setup examples, to know how to use each of these options.

VAT Exemption Cause

Available only for sales, it allows to specify the exemption cause code in the cases in which the VAT is 0%, either because it is exempt, or because it is not subject (TAI codes and 7, 14).

Special Regime Key

Available for purchases and sales, it allows to indicate the key that will be applied, independently of what is configured at the level of General Product Posting Groups and the General Setup.

Operation Description

Available for purchases and sales, it allows to indicate the key that will be applied, independently of what is configured at the level of General Product Posting Groups and the General Setup.

Service

Only available in sales, this option indicates that the amounts correspond to a service. This field will be used when generating an invoice to a non-national customer, or one whose NIF begins with "N". In such cases, the tax agency requires a breakdown between the amounts corresponding to the delivery of goods (those without this mark) and those corresponding to services (those with this mark).

Reverse Charge (ISP)

In the case of purchases, it will cause the amounts to be broken down into the VAT ISP fields intended for this purpose.

In the case of sales, the amounts will not be separated between those that have a reverse charge and those that do not, but the key S1, S2 or S3 will be assigned depending on what is configured here.

Non-deductible VAT

In the case of purchases, lets you specify that the VAT should not be added to the Deductible amount of the invoice.

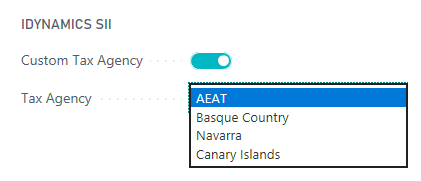

Custom Tax Agency

From the General group of fields in the VAT file, selecting the Show more fields option, we have access to the customization of the tax agency to which the invoices will be assigned with this VAT setup. This allows you to have the AEAT as the default tax agency, but to send the invoices with IGIC to the Canary Islands agency automatically, or vice versa.

If the Custom Tax Agency option is not active, the Tax Agency selected below will have no effect.

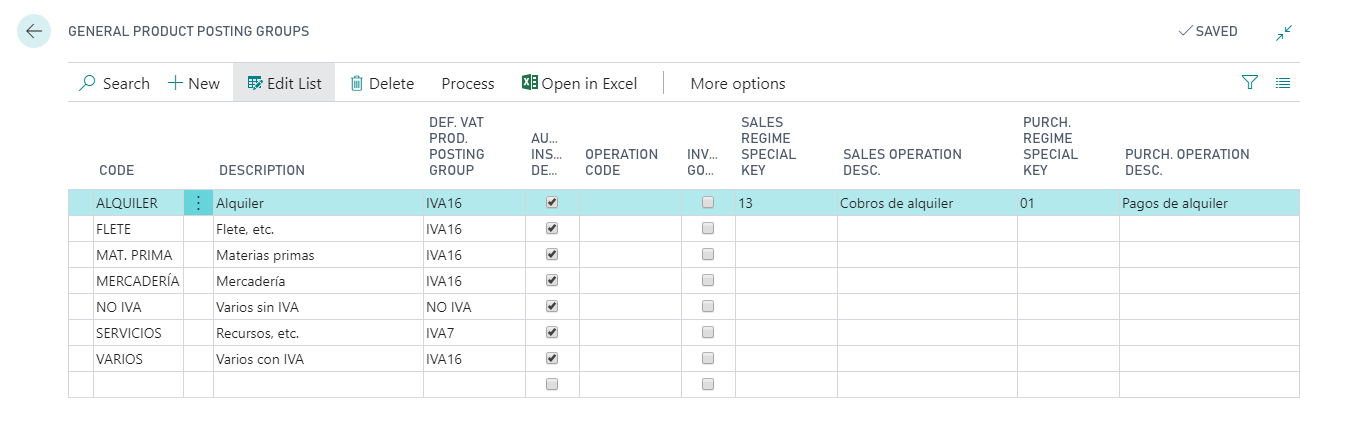

General Product Posting Groups

In this table, it is possible to indicate which products correspond to investment goods, by marking the option of the same name. If checked, when an invoice includes a product line associated with this group, iDynamics SII will automatically create an investment goods communication to the tax agency, in addition to the invoice communication (there could be multiple investment goods communications per invoice).

In addition, the table also has fields, hidden by default (we recommend using the setup of VAT registration groups, which is more flexible), which allow associating a special regime key to the sales and purchases of products of that group, and a predetermined description of the operations.

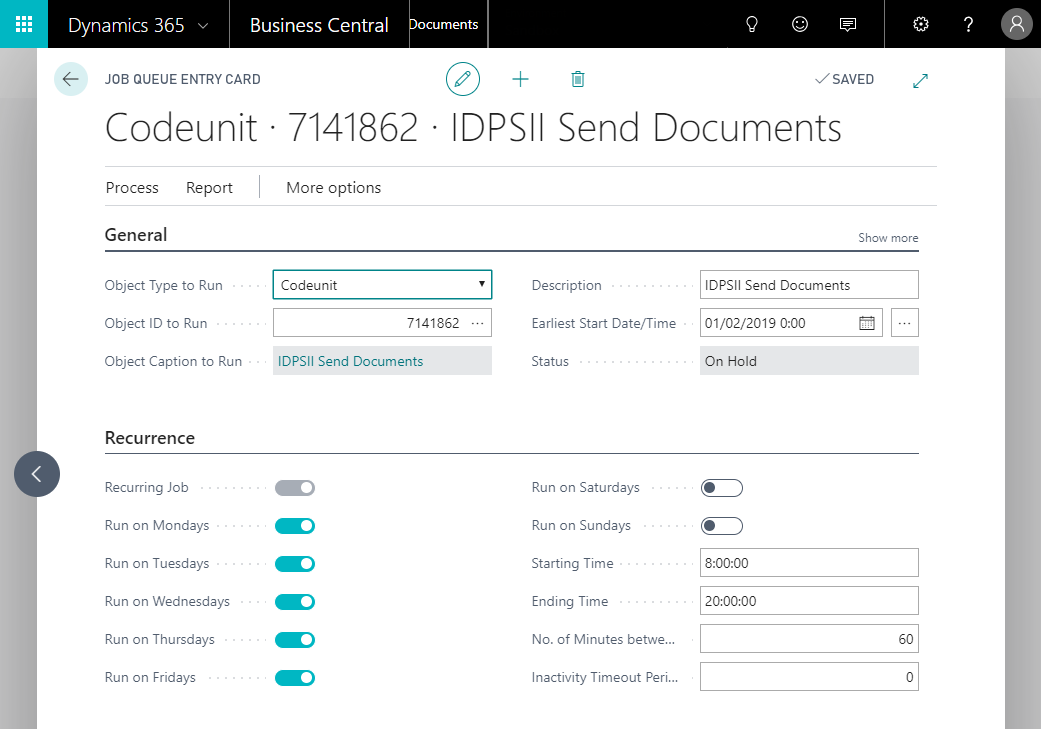

Scheduling Automatic Exports

The export of data to the SII platform can be done manually or programmed to be done automatically, using the Dynamics 365 Business Central project queue.

To do this, it is only necessary to program the execution of Module 7141862. Its execution will launch the process which will create the records in the sending queue to the SII and send all the records which do not require manual revision.

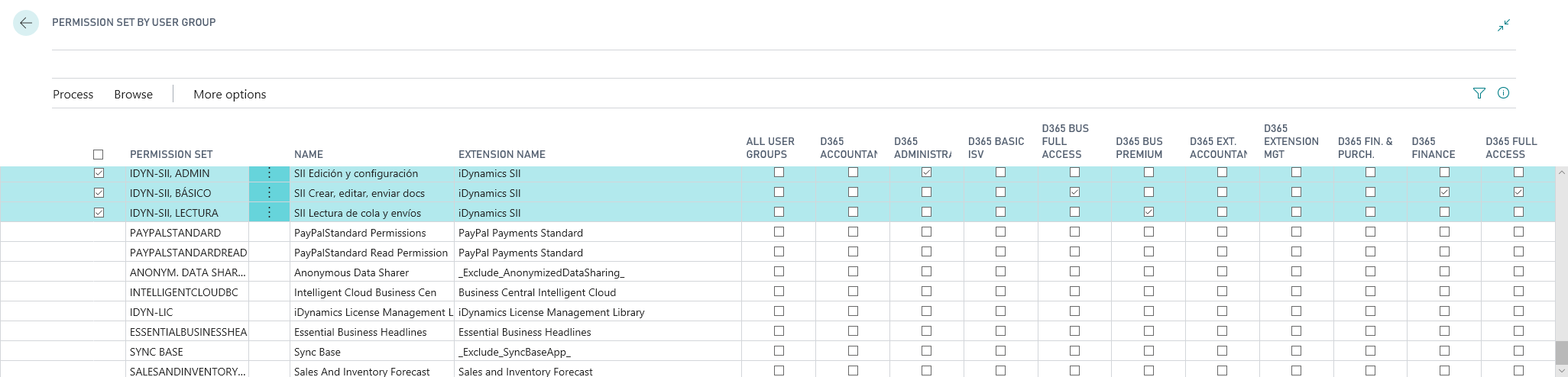

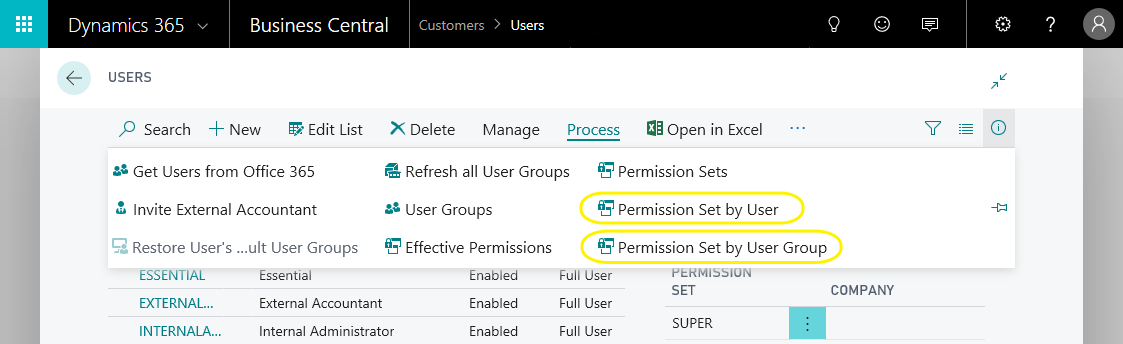

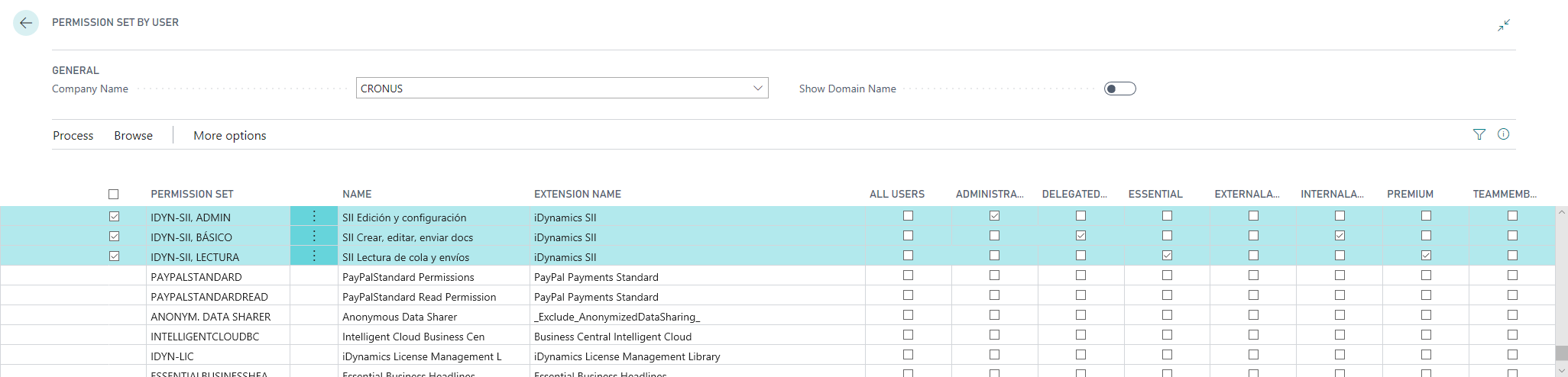

Assigning Permissions

Finally, in order for users to be able to use the functionality, it is necessary to assign them permissions. From the users' list, we can use the options "Set of Permissions per User" or "Set of Permissions per User Group".

Permission Set by User

Select the set of permissions and assign it conveniently to the users.

Permission Set by User Group

Select the set of permissions and assign it conveniently to the user groups.