iDynamics SII - VAT Identification Type

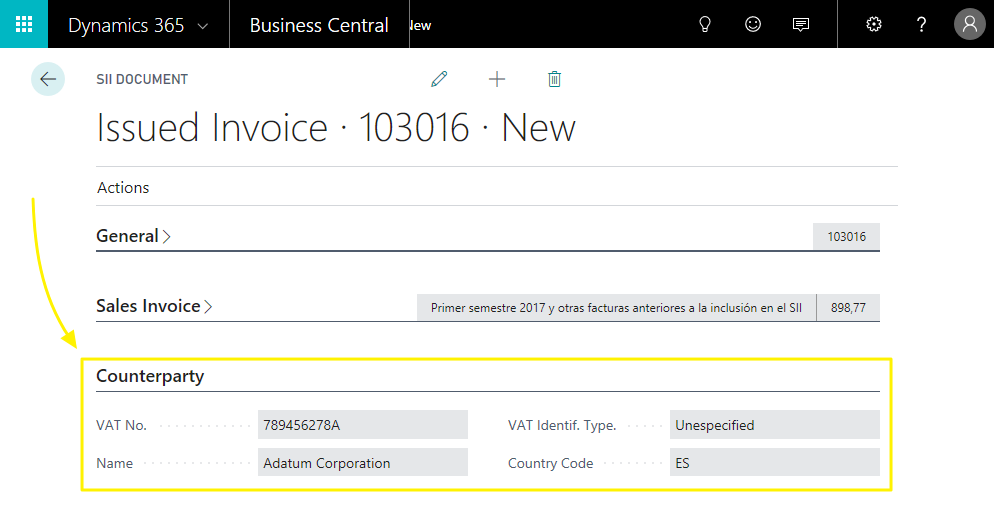

Most of the documents to be sent to the tax agency include a counterparty block, in which the vendor data (in the case of a purchase) or of the customer (in the case of a sale) is indicated.

Given that this block, and the validation of the CIF/NIF indicated therein, is one of the points that can cause the most validation errors when sending data to the SII platform, this document aims to document and clarify what the different types of identification that the tax agency allows correspond to, in addition to resolving the most frequent doubts.

Identification Types

Without Specification

If no type is indicated, the Spanish tax agency expects a Spanish CIF/NIF.

The tax agency has an algorithm that validates that the name of the company or person coincides with the CIF/NIF. This algorithm tries to give a margin of error (e.g. absence of the second surname, abbreviation of the name), but, officially, the name must be indicated in the format "SURNAME(S) NAME", without punctuation marks (although we have verified that currently the service does not have problems in accepting a comma between the surnames and the name).

If the NIF corresponds to a natural person who, for some reason, is not registered in the census of the tax agency, you will need to use use the type "07 - Not in census", after making a first attempt to send the data.

02 - NIF-VAT

This rate applies to European CIF/NIF numbers, including Spanish CIF/NIF (though it does require them to have an intra-community VAT identifier).

The tax agency expects the format to be a European VAT identifier, starting with two letters of the corresponding country. If the customer's CIF does not have these two letters, our solution automatically adds them from the country field (which is not sent to the tax office in this case).

03 - Passport

The passport number.

At this moment we have not received any incidence nor do we have information about any particularity that affects this case.

04 - Official Document Issued by the Country of Residence.

This type allows you to send any identifier, given that the tax agency will not validate it. This is something to use when we have the CIF or equivalent of a non-EU country, or an EU identifier that does not have an intra-community VAT identifier.

05 - Residence Certificate

The residence certificate identifier.

At this moment we have not received any incidence nor do we have information of any particularity that affects this case.

06 - Other Documentary Evidence

It is somewhat equivalent to 04 (the tax agency will not validate it), but it is used when we do not have any type of identifier equivalent to the Spanish NIF/CIF. For example, this case would allow us to indicate a telephone number of the company from which we are buying.

07 - Not Registered

This case is very particular, and was thought for cases in which a Spanish NIF is not yet in the census of the tax agency. In order to use this option, the tax agency indicates that at first, it will be necessary to try to send the document using 02 or without specifying, and in case of error to send it with a 07 (the document will be accepted provisionally with mistakes).

Country Code

The country code is compulsory in all types of identification except "Unidentified", since it must be a Spanish CIF/NIF, and "02 - NIF-VAT", since the country code must be indicated in the first two letters of the identifier.

In the case of type 02, however, iDynamics SII will verify the client's country code and, if the identifier does not begin with these letters, the SII will concatenate it in front of the identifier number before sending it to the tax agency.

As particularities of the latter case, iDynamics SII takes into account the exception of GR (Greece) whose identifier begins with "EL", and of the United Kingdom whose country identifier UK is usually used, but the ISO code (used for European VAT identifiers) is GB.

iDynamics SII expects the country codes to follow the standard ISO codes accepted by the tax agency. If this were not the case, it would be necessary to make a customization that transforms the codes used by the client into the corresponding ISO codes.

Counterparty in Imports

An important detail to take into account as it can cause considerable confusion: in the case of imports from outside the EU (type F5, with specified DUA data), and according to the documentation of the tax agency, the correct action is to indicate the data of the purchasing company itself as counterparty.